Why your AP team spends 40 hours a month retyping information that already exists—and what three companies did to fix it.

Claudia Ochoa, SMB Lead at Celeritech | Reading time: 10 minutes

Table of Contents

- The Hidden Cost of “Just How We Do AP”

- What the Keystroke Tax Actually Costs You

- “But We’re Different—Our AP Is Complex”

- What Three SAP B1 Teams Did Differently

- How It Actually Works: The 7-Step Process

- “What About Our Controls?”

- A Day in the Life: Before vs. After

- What You Need to Start

- The Real Question: What Would Your Team Do With 140 Hours Back?

I was at a Company site, and I watched a Controller last Tuesday spend 12 minutes entering a single vendor invoice into SAP Business One. Almost cried!

She opened the email. Downloaded the PDF. Opened SAP. Navigated to AP Invoice. Typed the vendor name. Entered the invoice number. Keyed in the date. Manually entered six line items. Selected GL accounts from memory. Saved the PDF to a folder. Navigated back to attach it.

Twelve minutes. One invoice.

Her team processes 800 invoices a month. That’s 160 hours of pure retyping—$3,200 to $4,800 in labor costs every single month, just to copy information from one digital format to another.

She called it “just how we do AP.”

I call it the keystroke tax.

1. The Hidden Cost of "Just How We Do AP"

If you run AP in SAP Business One, this probably sounds familiar:

7:00 AM – Check the AP inbox. 47 new vendor invoices arrived overnight.

8:15 AM – One invoice complete. Forgot to attach the PDF. Navigate back, find the file, attach it.

By 3:00 PM – You’ve processed maybe 25 invoices. The rest will wait until tomorrow. Some will miss the discount window.

2. What the Keystroke Tax Actually Costs You

- Time (The Visible Cost)

For a team processing 800 invoices/month:

- Average 12 minutes per invoice

- 160 hours/month = One full-time employee doing nothing but data entry

- $48,000-60,000/year in AP labor cost

- Errors (The Expensive Cost)

When humans retype, humans make mistakes:

- Transposed vendor invoice numbers → duplicate payment risk

- Wrong GL account → month-end corrections

- Incorrect PO match → inventory variance investigations

- Missing GRPO link → can’t close the receipt

Each error costs 15-45 minutes to research and correct. At a typical 3-8% error rate, that’s another 20-30 hours/month in rework.

- Delays (The Invisible Cost)

Missed early payment discounts:

- Invoice arrives Monday

- Sits in email until Wednesday

- Entered Thursday, routed Friday

- Approved the following Tuesday

- 12 days elapsed → Discount window closed

At 2% on a $20,000 invoice, you just lost $400. Do that 4 times a month: $19,200/year in cash you’ll never see again.

Strained vendor relationships: “We’re processing it” becomes your default answer. Late payments become your reputation.

Late fees: Some companies charge 1.5% monthly interest on overdue invoices like us. That’s 18% APR you’re paying because an invoice sat in email.

3. “But We’re Different—Our AP Is Complex”

For the past 2 months, I have heard this every week. Your invoices aren’t simple:

- Partial GRPOs (vendor invoices before full receipt)

- Freight allocations split across line items

- Multi-currency with exchange rates

- Three-way matching (PO → GRPO → Invoice)

- Department-specific GL rules

- Complex approval matrices

Here’s what’s also true:

Even in “complex” AP, 80% of invoices follow predictable patterns:

- PO-based with full GRPO

- PO-based with partial GRPO (standard handling)

- Non-PO under $500 (standard expense account)

The remaining 20% are genuinely unique and should stay manual.

But right now, you’re treating all 800 invoices like they’re the 20%.

4. What Three SAP B1 Teams Did Differently

Case 1: $50M Distributor (320 invoices/month)

Before:

- 1 AP clerk, 20 hours/week on data entry

- 3-5 day lag from email → SAP B1

- Missed 3-4 discounts/month ($1,200-1,800 lost)

- 4-6 weeks to train new AP clerk

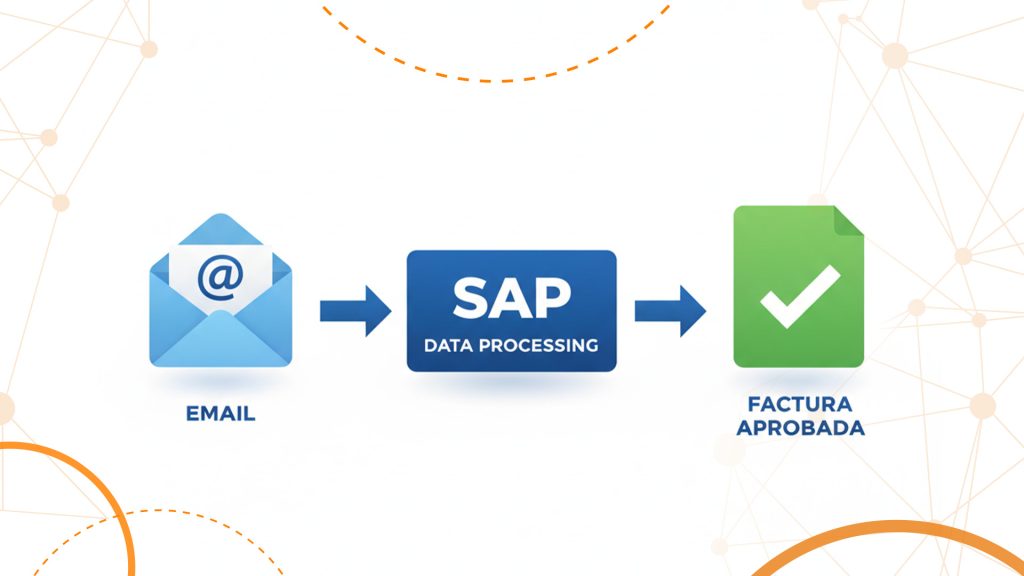

What they changed: Connected AP inbox directly to SAP Business One. The system:

- Reads vendor emails as they arrive

- Extracts invoice data (header + lines)

- Matches to PO/GRPO in SAP

- Applies GL rules by vendor type

- Attaches supported PDF to AP document

- Creates AP invoice DRAFT ready for approval

After (30 days):

- Same clerk, 2 hours/week on exceptions only

- Same-day posting (9 AM email → 9:15 AM in SAP)

- 95%+ discount capture

- New clerk productive by day 5

Their CFO: “I was worried this would bypass our approval matrix. Then I realized it just creates the document—our workflow stays intact. Our financial monthly closing is happening faster”

Case 2: $75M Pet Manufacturer (1,200 invoices/month, complex freight)

Their complexity:

• 40% of invoices include freight needing allocation

• Multi-site receiving (3 warehouses)

Result:

• 65% fully automated (including freight allocation)

• 25% drafted and flagged for quick review (partial GRPO, high variance)

• 10% exceptions to senior AP (truly unique)

Their AP Manager: “We thought our freight charges allocations were too personalized. Turns out 80% follow three patterns. Now my team reviews instead of calculates.”

Case 3: Multi-Entity Food Importer ($110M, 600 invoices/month)

Their complexity:

• Two legal entities in SAP B1

• Multi-currency (USD, BAHT, PESOS MX)

• Customs/duty invoices with special GL

• Spanish and English invoices

• Wildly varying vendor formats: excel, body email, pdf

Configuration:

• Entity-specific GL rules

• Currency detection with variance alerts

• Document type recognition

• Bilingual processing

Their AP Controller: “We had the business owner who ‘knew imports.’ When he vacationed, we backed up for two weeks. Now the system applies rules consistently.”

5. How It Actually Works: The 7-Step Process

Step 1: Automatic Intake

Vendor sends to [email protected] → AI reads within 60 seconds → Captures PDF and metadata

Step 2: Data Extraction

Reads invoice like a human:

- Vendor name, invoice #, date

- PO number

- Line items: description, quantity, price

- Tax and totals

Speed: 3-5 seconds, 98%+ accuracy after learning your vendors

Step 3: Intelligent Matching

Looks in SAP B1:

- Finds referenced PO

- Checks GRPO status

- Compares quantities

- Flags discrepancies:

- “Invoice qty (100) exceeds GRPO (75)” → Partial GRPO

- “Price variance: PO $10.00, invoice $10.50” → Review needed

- “No PO found” → Exception

Step 4:GL Logic

Applies your own rules:

- Inventory items: Item master GL (standard SAP)

- Freight: Your rule (e.g., 5100)

- Services: Department GL by vendor type

- Exceptions: Flag for human assignment and learn for next time!

Step 5: Document Creation

Creates AP Invoice with:

- All data populated

- GL accounts assigned

- PDF attached (Attachments tab)

- Email saved as reference

- Audit timestamp

Status: Draft or Ready for Approval—not auto-posted

Step 6: Approval Routing

Your matrix:

- Under $5K → Auto or AP Manager

- $5K-$25K → Controller

- Over $25K → CFO

- Non-PO → Always manager

- New vendors → Extra verification

Approvers get email/WhatsApp with invoice details and approval link.

Step 7: Exception Handling

The 15-20% that don’t fit patterns surface in “Exceptions” queue:

- Partial GRPO needing complex allocation

- Price variance over threshold

- No PO found

- First-time vendor. AI-powered learns for next time

- Quantity mismatch

Your team reviews, decides, posts manually. System learns from their choices.

6. "What About Our Controls?"

Your approval matrix doesn’t change. System triggers workflow automatically—instead of waiting for manual routing.

Every action logged:

Email timestamp (received)

Data extraction (system log)

Extracted data (stored)

Approvals (SAP log)

PDF attached to document

Auditors love this. Everything’s linked.

Vendor master changes: Still dual approval

Bank updates: Still your process

Creation and payment: Still separate

Anything uncertain gets flagged. You handle the 20% needing judgment; AI handles the 80% that’s straightforward.

7. A Day in the Life: Before vs. After

Time | Before | After |

|---|---|---|

7:00 AM | See 47 emails. Groan. Start downloading PDFs. | See dashboard: • 42 invoices created overnight (matched, ready for approval) • 5 exceptions: o 2 partial GRPOs (need allocation) o 1 price variance ($10 → $10.50) o 1 new vendor (verify) o 1 missing PO (clarify) |

8:00 AM | 8 invoices entered. 39 to go. Already behind. | All 5 exceptions reviewed and resolved. 42 approved invoices batched for payment. Checked cash flow. Identified 6 eligible for early discount. Emailed CFO asking priorities. |

10:00 AM | Vendor calls asking status. Stop work. Search email. Check SAP. Piece together timeline. | Vendor calls. Search invoice #. “Received yesterday 2:14 PM, created 2:15 PM, approved 3:30 PM, queued for Thursday payment.” |

3:00 PM | 28 invoices done. 19 pending until tomorrow. Some will miss discounts. | All 47 processed (42 auto + 5 manual). Payment run ready: $187K. Discount opportunities: 3 invoices, $1,240 potential savings. Spent afternoon analyzing vendor terms for better discounts. |

The Objections I Hear

"Our AP is too complex to automate"

Question: Which 80% follow patterns, and which 20% need human judgment?

"Our team will resist change"

• Same-day posting vs. 3-day backlog

• 5 exceptions vs. 47 manual entries

• 10-second status answers vs. 10 minutes

• Time for discount optimization vs. data entry

They become advocates.

One AP Manager: "My team was skeptical. Two weeks in, someone said, 'If you take this away, I'm quitting.' She went from dreading Monday floods to enjoying AP analysis."

"We're not big enough"

• 500 invoices × 12 min = 100 hours/month

• At $30/hour = $3,000/month

• Annual: $36,000 in data entry

75% reduction = $27,000/year saved plus improved accuracy and discount capture.

Breakeven threshold: 300+ invoices/month, 20+ hours manual entry = pays for itself in 10-14 months.

"What if AI makes a mistake?"

• AI mistakes: Consistent, fixable (adjust rule once)

• Human mistakes: Random, recurring (same person, same error, twice)

Safety net:

• Exceptions flagged before posting

• Approval workflows in place

• Variance thresholds trigger review

• Full audit trail

You're not eliminating oversight—you're redirecting it from "check every invoice after entry" to "review exceptions before posting."

8. What You Need to Start

- Shared AP Inbox (15 minutes)

One address ([email protected]) that system monitors. Stop individual email accounts.

- Clear GL Rules (2-3 hours)

Document how you assign accounts:

- Inventory → Item master

- Freight → 5100

- IT services → 6200

If your clerk “just knows,” have them write it down.

- Defined Approvals (1 hour)

Who approves what:

- Under $5K → AP Manager

- $5K-$25K → Controller

- Over $25K → CFO

- Non-PO → Always manager

- Sample Invoices (10 minutes)

5-10 recent invoices (different vendors, types). System learns your formats.

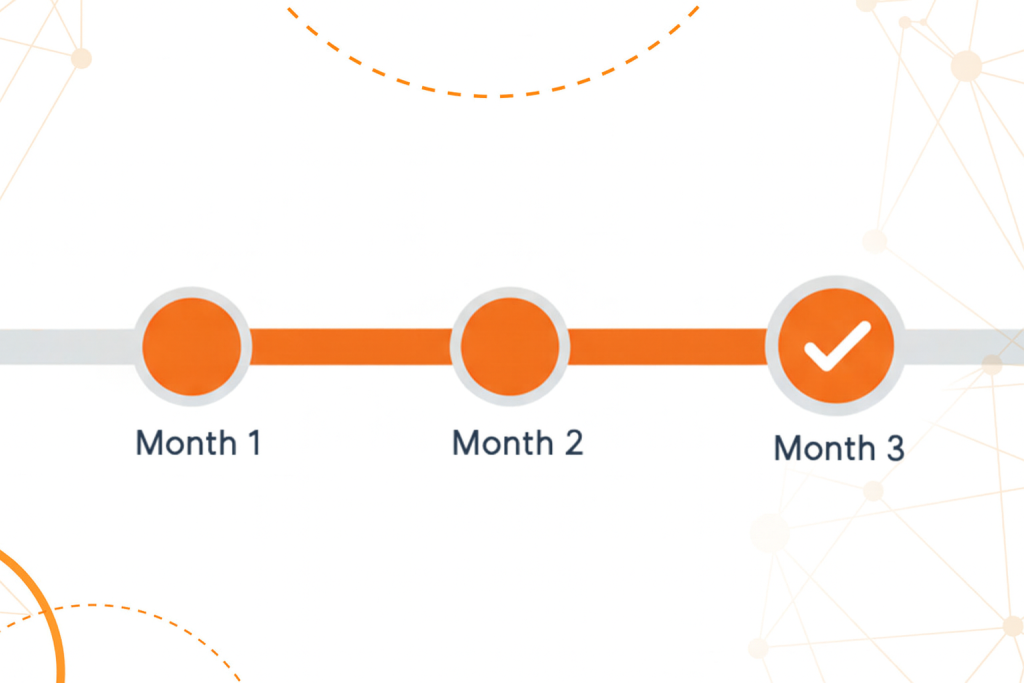

- Implementation Window (30 Days)

Week 1: Intake setup + attachments Week 2: Exception handling Week 3: In-app guidance Week 4: Live answers + tuning

You continue manual processing during setup. System runs parallel until confident.

Your time: 3-4 hours/week during setup

The 90-Day Transformation

Month 1: Foundation

- 24/7 inbox monitoring

- Auto-capture from email

- Simple invoices (PO + full GRPO) automated

- Exceptions manual

- Result: 40-50% time savings

Month 2: Optimization

- System learns vendors (80% → 95% accuracy)

- Exception patterns automated

- Approvals tuned

- In-app guidance live

- Result: 70-80% time savings

Month 3: Transformation

- Team focuses on analysis, not entry

- Same-day processing standard

- 90%+ discount capture

- Days (not weeks) to onboard

- Result: 85-90% savings; higher-value work

9. The Real Question: What Would Your Team Do With 140 Hours Back?

Some teams:

- Analyze vendor terms, renegotiate discounts

- Implement dynamic discounting

- Clean old AP balances

- Build cash flow forecasting

- Cross-train into AR/Treasury

- Actually take vacation

Others:

- Handle growth without hiring (800 → 1,400 invoices, same 2-person team)

- Bring outsourced AP in-house (better control, lower cost)

- Implement vendor scorecarding

One CFO: “We promoted our senior AP to AP Analyst. She finds cash optimization opportunities instead of typing. That role saved $47K in captured discounts this year.”

Your Three Options

Option 1: Keep doing this

- Cost: $48-60K/year + missed discounts + late fees

- Risk: Key person dependency, errors, strained relationships

- Outcome: Same backlog, stress, missed opportunities

Option 2: Hire more

- Cost: $55-65K/year per clerk + benefits + training

- Risk: More people doing inefficient work

- Outcome: Faster, but still manual and error-prone

Option 3: Eliminate the retyping

- Cost: Less than one clerk’s salary

- Risk: 30-day implementation, change management

- Outcome: 85-90% time savings, better accuracy, captured discounts, happier team

See It in Action

I’ll show you:

- Email → SAP B1 AP document in 60 seconds

- Exception review process

- Approval routing with your workflow

- Your specific ROI

15-30 minute screen share. No slides. No pressure.

One More Thing

- The keystroke tax isn’t just about money or time.

- It’s about the Controller who can’t vacation because “no one else knows month-end.”

- It’s about the CFO surprised by cash needs because AP is 3-5 days behind.

- It’s about the vendor relationship strained because “your payment is always late.”

- You didn’t implement SAP Business One so your team could do more data entry.

- You implemented it so they could make better decisions, faster.

Let’s get you there!

About Celeritech

We also build AI tools that work with SAP Business One—not around it. SmartAP, Helpie, and Astro eliminate manual work while keeping your controls, approvals, and audit trails intact.

Questions? [email protected] | ai.celeritech.biz